What’s happening to house prices?

Spring 2023 Market Review

Written by: Richard Antrobus Category: News May 1, 2023

What’s happening to house prices?

Typically, the property market experiences a surge in activity during spring, with a higher number of homes listed for sale and more people looking to move. Consequently, average asking prices usually increase during this season due to increased competition among buyers. However, the average house price in Great Britain only rose by 0.2% to £366,247 this month, which is below the average rise expected during this time of year. This suggests that people looking to sell their properties are adopting a more realist pricing strategy to attract a buyer.

While the property market is not as frenzied as it was in previous years, we are still experiencing demand from a range of house hunters including people keen to find new homes in your area. Many sellers understand the need to price their homes competitively to attract Spring buyers, and this may be contributing to the stability in the housing market. We are also pleased to confirm that the number of ‘sales agreed’ has recovered after a slump following September’s mini-Budget, and demand from home-buyers is starting to rise as we enter the spring market. These factors suggest that the property market is still active and that people are willing to move despite ongoing economic difficulties.

What does this mean for first time buyers?

The high competition for rental homes and record high rents could indeed be a contributing factor in making home ownership more appealing for some individuals. People renting are struggling to keep up with rising rental costs and may start to see the advantages of investing in a property of their own, which could provide them with a more stable and potentially cheaper alternative to renting in the long run. Additionally, historically low mortgage rates may also be enticing more people to take the plunge into home ownership.

It’s good to see that mortgage rates have edged down over recent weeks, making home ownership a more attractive prospect for those who are able to secure a mortgage. It’s worth noting, however, that mortgage rates can vary depending on the lender and the borrower’s individual circumstances, so it’s always a good idea to shop around and compare rates before making a decision. Additionally, it’s important to ensure that you can comfortably afford the monthly mortgage payments, taking into account other expenses such as utilities, maintenance, and insurance.

Expert thoughts on house prices

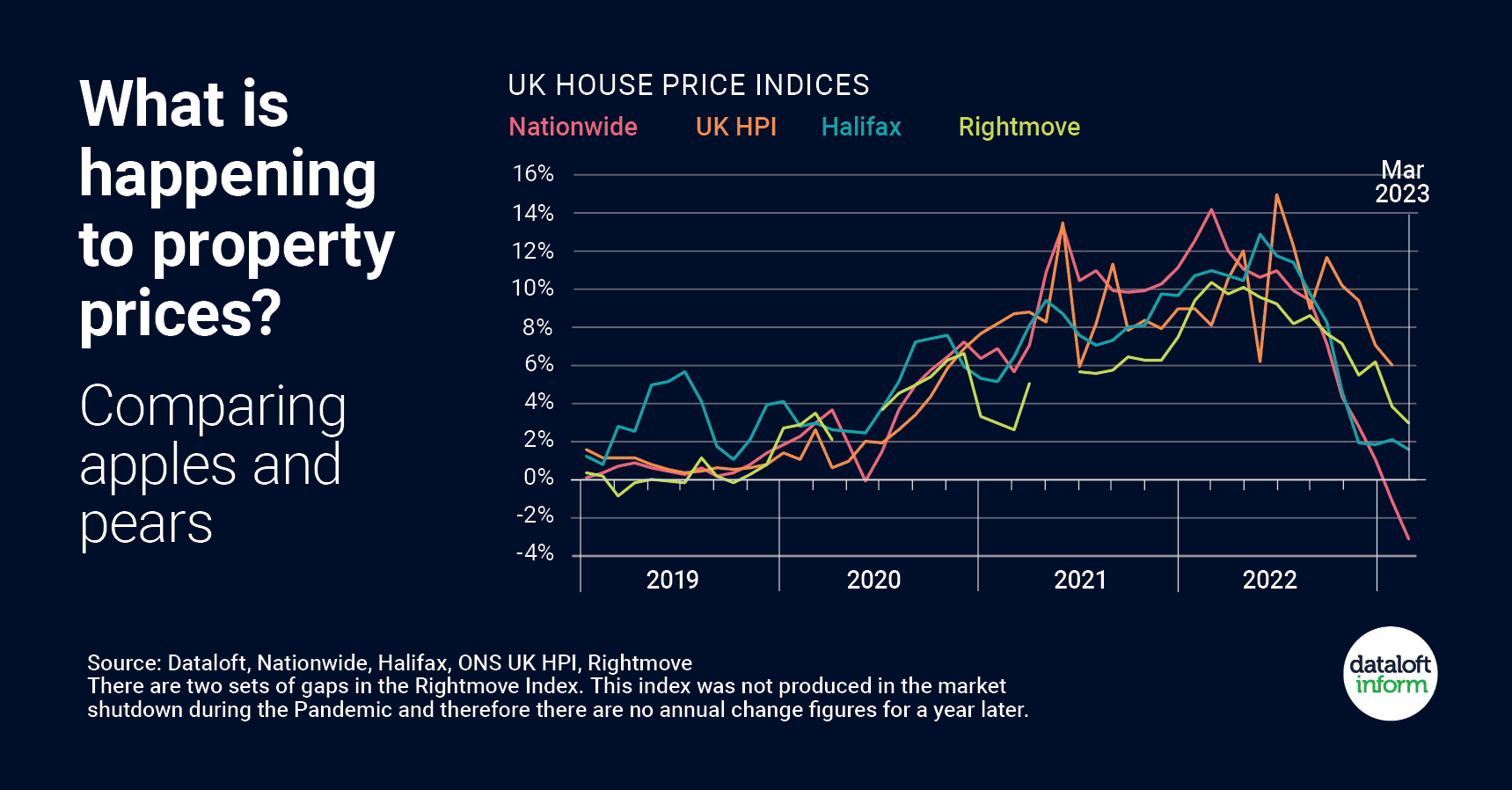

- Average UK house prices and annual price growth are published by various organisations. However, the figures are different for each and can cause confusion. This is because the data is calculated in slightly different ways.

- Rightmove average prices are the highest, but their index is based on the asking prices of newly listed properties (around 100,000 each month), not on sales prices. In comparison, the ONS UK HPI index uses final sales prices, including for cash and mortgage sales, recorded by the Land Registry. It includes around 80,000-100,000 sales per month.

- Halifax and Nationwide use their own mortgage applications at approval stage (around 12,000-15,000 per month). The average price quoted by Nationwide is usually the lowest. The differences in the source of the data, as well as the statistical calculations that make up each index, explains their variations.

- Comparing the indexes against each other is like comparing apples with pears. However, despite the variation in methodologies, the overall trend direction noted by each organisation is similar. It is this overall trend which is important when considering what is happening in the current market.

Our thoughts on the Spring market

Our Director, Richard Antrobus comments: In the current climate, our main focus is helping our clients navigate the changing market conditions. With increase number of available houses for sale, it’s important for sellers to price their homes competitively to attract buyers. At VitalSpace, we are more than happy to providing guidance and advice to clients on how to price their homes appropriately which will no doubt be crucial in helping them to sell their homes quickly and at the best possible price.

If you’re thinking of putting your property on the market, speak with an experienced member of our team, armed with expert knowledge of your area and is best placed to discussed house prices in the ever changing market.