2022 Property Market

Property market prediction: What to expect in 2022

Written by: Richard Antrobus Category: News November 21, 2021

2021 has been one of the busiest for the housing market in more than a decade.

UK house prices have continued to rise strongly throughout this year, increasing by 5.6% in the first six months and driven by elevated levels of demand. It’s expected that by the end of the year, the UK will see prices rise by a total of 9.0%.

Estimates show that there will be 1.5 million completed sales this year, with the total value of homes changing hands at £473bn, some £95bn higher than in 2020, that’s massive.

This year, we have seen several trends driving the market which include:

- Attractive mortgage rates

- Stamp Duty Holiday

- Changing property requirements

- Need for a different kind of space (study / home office etc.)

On the 30th September, the stamp duty holiday in England ended means there are no more purchase tax savings. The post stamp duty saving months of October and November have given us a fairly good indication of what will happen in the market next year.

So what has the impact been over the last two months? We have found interest to be steady with clear signs that some of those pandemic drivers of market activity remaining in play. Of course, it has been clear to see that our upper end market has slowed down as purchaser demand decreases, however, low to mid market demand remains similar to that of March and April 2021.

2022 Property Market – What can we expect?

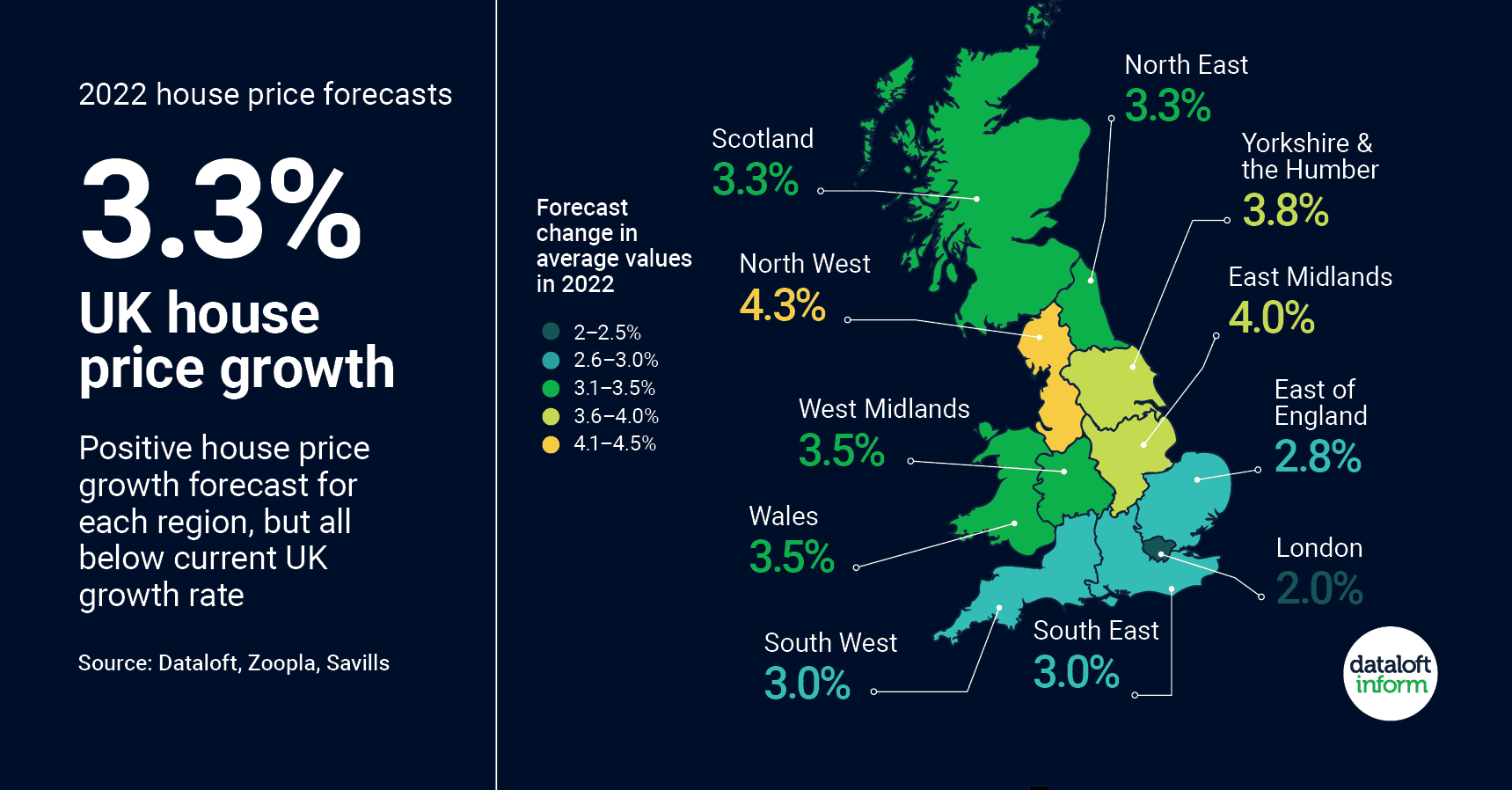

As more stability returns to the country, the property market will become more predictable. We look at Zoopla’s forecast for the year ahead.

In a recent Zoopla survey, it would appear that more than a fifth (22%) of households plan to move over the next 18 months as a direct result of the pandemic. Those most likely to move were younger people who live in cities, suburbs or large towns. Many plan to move to other cities and towns, while some hope to switch to a more rural lifestyle.

We are pleased to see that Zoopla predict demand will still be high, however, there are several finance elements to consider which may effect overall movement in the housing market. These include:

Will mortgage rates increase?

The Bank of England base rate remains at a record low of 0.1%, but we expect this to rise in the near future. An increasing Bank of England base rate will have a knock-on effect on mortgage rates, meaning it will cost house hunters per month in mortgage repayments. Zoopla comment, buyers have become accustomed to low mortgage rates. The portal predicts rates will reach an average 3% by the end of 2022. This would be the highest since 2015, but still historically low.

At VitalSpace, we expect the Bank of England to increase the base rate as soon as next month, with further such rises predicted in Q1 2022. This step has the ability cool purchaser demand in the months ahead as borrowing costs increase.

Available housing supply

The demand for homes during 2021 has sent the market into overdrive with buyers desperate for somewhere more spacious to live. According to experts, this doesn’t seem like it will end anytime soon, with prices expected to remain high and demand in turn also remaining high. A persistent lack of homes for sale paired with unrelenting demand will results in property prices remaining high.

Of course, with limited housing inventory, we expect it to remain a ‘sellers market’ with multiple buyers chasing each and every property that we put to the market.

What do we think?

You can never predict the future, however, at VitalSpace Estate Agents, we are keen do provide our thoughts and predictions on the 2022 Property Market.

We feel that whilst mortgage rates will no doubt increase in the next few months, available housing inventory is set to remain low for some time. With increasing mortgage rates, demand may decrease a touch as some buyers struggle to afford rising monthly repayments. However, we very much still predict that demand will remain at a level whereby growth will occur, albeit a more stable rate of property growth. It’s expected that by the end of the year, the UK will have seen property prices rise by a total of 9.0%. We predict 2022 Property Market will grow by circa 4.5% during which is healthy, yet still higher than the anticipated 2022 average increases in salaries, predicted to be around 3%.