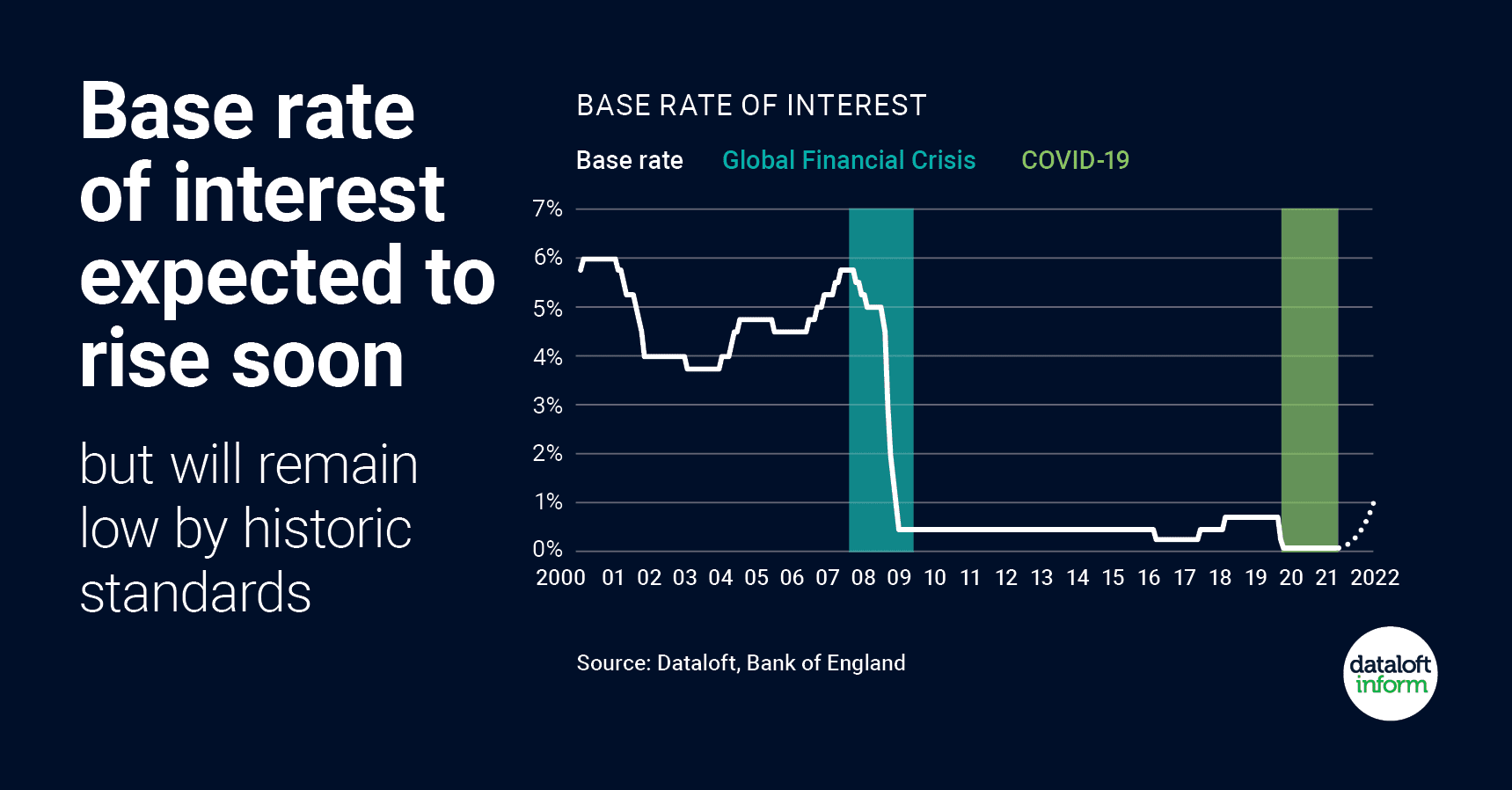

If you’ve picked up a newspaper or turned on the TV over the last couple of months, you will have noticed that the UK’s base rate is a hot topic at the moment.

What is the Bank of England Base Rate?

The UK Base rate is the official interest rate set by the Bank of England. When the Bank of England decides to change the official interest rate, this can have an effect on your mortgage payments.

What will happen to my mortgage if the UK Base rate changes?

The impact of any change will depend on the type of mortgage you have, the amount you’ve borrowed and how long you’ve taken it out for. If any part of your mortgage is on a variable rate and your rate changes following a change to the Bank of England Base Rate, your payment may go up or down. If this happens, your monthly mortgage payments will likewise change.

What could happen?

- The UK Base rate of interest is set to rise in the ‘coming months’ as the Bank of England acts to control the UK economy.

- The Bank voted to keep the base rate at its historic low of 0.1% in November, but with inflation 3.1% and predicted to rise to as much as 5% in the first half of 2022, a rise is likely.

- Any rise will impact mortgage borrowing costs, although with an estimated 80% of borrowers on fixed rate deals, no significant adjustment to the housing market is anticipated in the short term.

- Compared to the Global Financial Crisis in 2008/09, when the base rate was often in excess of 5%, the rate by the end of 2022 is expected to be a maximum of 1%.

- Raising the base rate encourages people to save, not spend,. This should slow the increase in prices of household goods.

The base rate hasn’t been increased since before the financial crisis in 2007 and the majority of economists seem to think the time is now right for an increase. So, whether it happens in December or early next year, the forecast for the next six months is that the Bank of England will increase interest rates to 0.5%, with the potential of further increments to follow.

Source: Dataloft, Bank of England