Stamp Duty Changes 2025

From April 1st 2025, changes to Stamp Duty rates in England will come into effect.

Here's what you need to know:

Written by: Richard Antrobus Category: Buying, News February 8, 2025

Stamp Duty Land Tax (SDLT or Stamp Duty) is a tax payable to HM Revenue and Customs (HMRC) when buying a property or land in England and Northern Ireland. The amount of SDLT liability will depend on several factors, including (but not limited to) whether a buyer is:

- A UK resident

- Purchasing a property as an individual or company

- A first-time buyer

- Replacing a main residence

- Purchasing additional property

In September 2022, the government raised the 0% Stamp Duty Land Tax threshold for residential properties from £125,000 to £250,000. The aim was to help stimulate the housing market and support the many jobs and businesses dependent on it. This temporary measure was designed to reduce the upfront costs for homebuyers and make it easier for people to get onto or move up the property ladder.

However, the government has confirmed that this relief will end on 31st March 2025, with the threshold returning to £125,000 from the 1st April 2025, as part of its ongoing commitment to fiscal responsibility and maintaining confidence in national finances.

If you’re planning to take advantage of this saving, it’s important to act soon. Property transactions, particularly those involving a chain, are currently taking longer to complete, so it’s wise to start your search as early as possible.

Stamp Duty Changes 2025

As mentioned, Stamp Duty Changes are set to kick in from April 2025, meaning stamp duty rates will change when purchasing a property in England.

Lets see how it may effect your property purchase:

Pre April 2025 Stamp Duty Rates – Main Residence

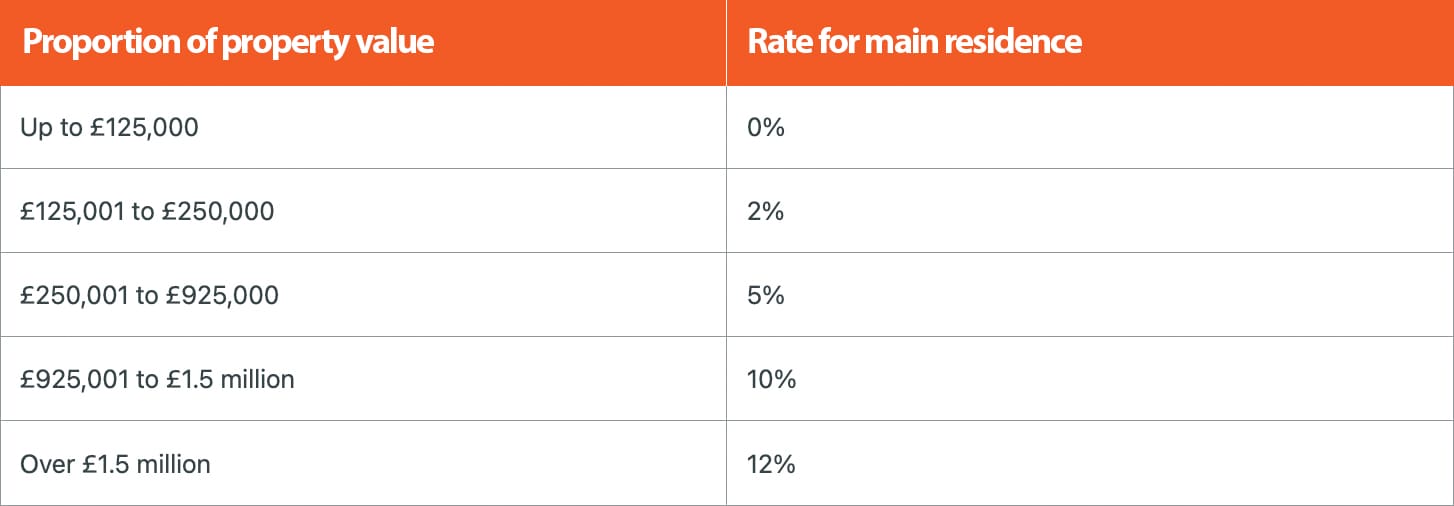

Post April 2025 Stamp Duty Rates – Main Residence

First Time Buyer Nil Rate Relief

We feel that the forthcoming stamp duty changes are likely to have the greatest impact on first time buyers. The government have confirmed that they will reduce the nil rate threshold down to £125,000 and also reduce the maximum purchase price for which first time buyers’ relief can be claimed by the same amount, it will make it even harder for some first time buyers to enter the property market.

Pre April 2025 Stamp Duty Rates – First Time Buyers

Currently, if you’re a first time buyer you don’t pay any stamp duty on property purchases up to £425,000, and if the cost of the property you’re buying is up to £625,000 you’re also eligible for discounted rates (5% on properties from £425,001 to £625,000).

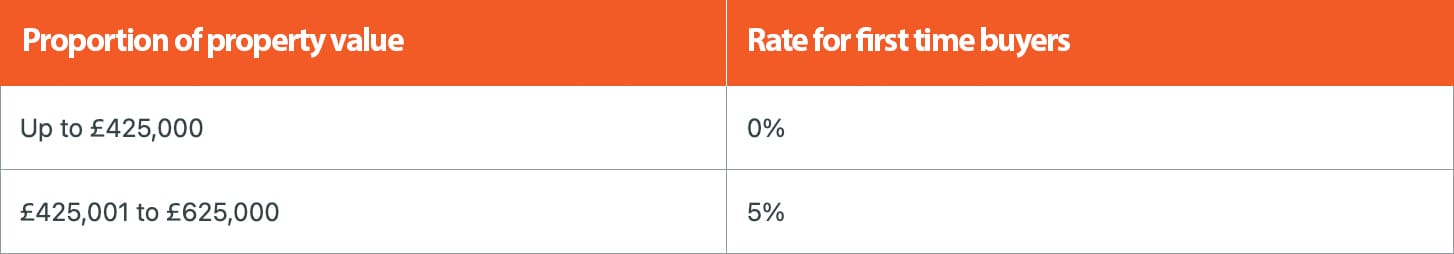

Post April 2025 Stamp Duty Rates – First Time Buyers

From 1st April 2025, first-time buyers won’t pay any stamp duty on property purchases up to a reduced figure of £300,000, and they’ll only get first-time buyers’ relief on properties up to £500,000 (5% on properties £300,000 to £500,000).

Changes For Additional Property Purchases

Pre April 2025 Stamp Duty Rates – Additional Home Purchases

Currently, buyers of additional properties already face a higher rate of stamp duty—known as the “stamp duty surcharge.” This surcharge currently adds 3% to the standard stamp duty rates for those buying a second home or buy-to-let property.

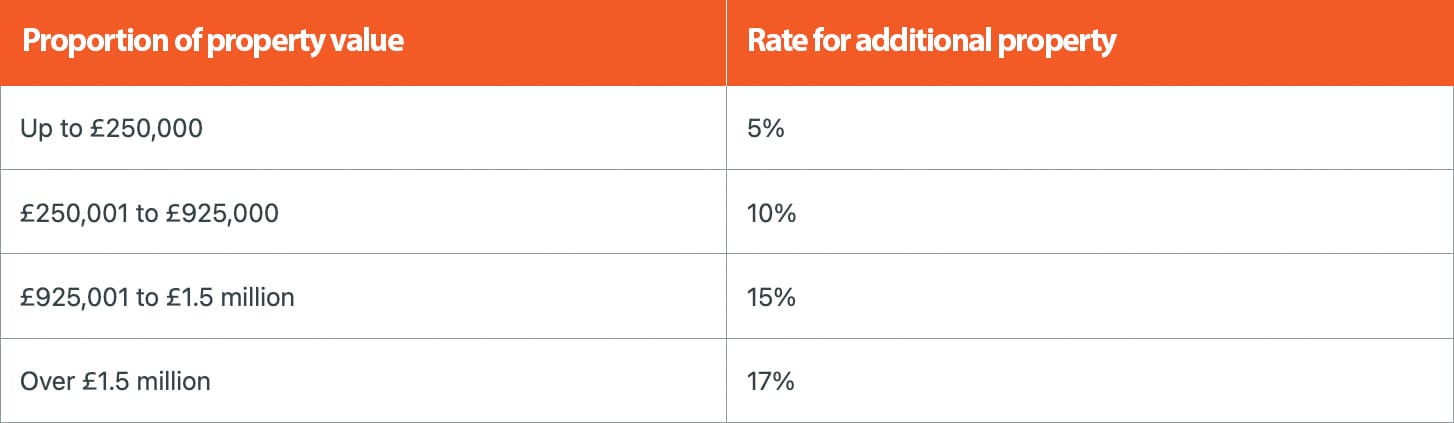

Post April 2025 Stamp Duty Rates – Additional Home Purchases

As of 1st April, 2025, an extra band will be added to the stamp duty thresholds specifically for additional property purchases, in line with the general changes to stamp duty that will be taking effect after the temporary increase ends.

How Could These Changes Affect You?

With the deadline approaching, there’s likely to be increased demand and pressure on the housing market, leading to potential delays in transactions as the date nears. Acting sooner rather than later could help you avoid these complications and take advantage of the current thresholds.

At VitalSpace, we want to ensure that home movers, buyers, and investors have the information they need to make informed decisions about their property transactions. If you’re considering buying or selling a property, it’s worth discussing how these changes might impact your plans.

For more information about stamp duty please – Click Here